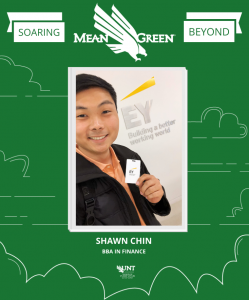

MEET SHAWN! He graduated with his Bachelor of Business Administration in Finance in May 2019. He is currently working as a Quality Assurance Financial Analyst for Ernst & Young.

We asked Shawn some questions, advice for current students, and how UNT helped him to succeed and SOAR BEYOND!

When you started at UNT, what were your plans after graduation? How have these plans changed? When I started at UNT, I didn’t really know what carriers or industries were out there. I was interested in learning about investments so I majored in finance, but I was still very clueless. In my last two years of college, I really enjoyed learning about personal finance, and I enjoy helping my friends with their personal finances. I actually had a 5-year plan when I was about to graduate, and I searched for jobs in Financial Planning throughout my senior year. But I actually lost my father from a heart attack right before graduation so things got a little difficult, and I realized life doesn’t always go according to plan. I’m an only child of immigrant parents, so I took a lot of responsibility and dedicated time after my graduation to help my mom organize my father’s accounts/documentation. A few months after I graduated from UNT I did land a job at EY as an analyst by a lot of hard work and some luck. But yes I can definitely say my plans have changed, and I would have never imagined I would be where I am today two or three years ago.

What advice do you have for prospective or current students as they decide what they want their next steps to be? I would definitely first recommend reading a book called The Defining Decade by Dr. Meg Jay. She also has a really good Ted talk that is about 15 min long, and I truly believe everyone who is soon to be or in their 20’s. Need to look into her studies as a clinical psychologist.

I also would recommend current students to talk and learn about personal finance. I honestly think money shouldn’t be a taboo subject and learning about how to manage a budget, personal debt, and your credit score are very important life skills. I feel people are scared to talk about their personal finances because they’re embarrassed or they just don’t know where to start. I would recommend going to the student money management center at UNT or listening to Dave Ramsey’s podcast and following the 7 baby steps. I feel both of these are a solid first step in understanding how to manage your personal finances.

Lastly, I would recommend looking into a life of Financial Independence. I’m currently involved in a community called FI/RE (Financial Independent/ Retiring Early) and I’m very close with a few of the national leaders, and the lead admin for the Dallas chapter. And I know some people are very against the idea of retiring early and pursuing a hobby for the rest of your life. But the ability to know you are able to live comfortably even if you get fired from your job the next day, or if you decide that this job isn’t worth your time. You are free to make choices because you’re FI (Financially Independent).

How did your program at UNT help you to feel prepared for this role? UNT definitely helped me in many ways to be prepared for my role today. I learned how to be independent, communicate professionally, and help others in need. I know I would not be where I am today without all of the staff and professors who helped me during my time at UNT. The roll I have at work requires a lot team communication and independent learning. I’m very thankful for my experience at UNT.

How did you find your current role? I actually found my job at the UNT Business Career Fair last year. I explained a little of my story in the previous email, but yes I am where I am because of the career center.

What was the toughest interview question they asked you? EY had me go through four interviews and a final case study. The first was pre-recorded and online, the second was over the phone, two were in person, followed by the case study. But I would say the final case study was the hardest interview process I had to go through. It’s a timed pressure test to see how well you can read a metric prompt and financial information on a client. Once the set time given was up you would have to answer questions on what you read and explain what you would recommend this client do and why. My case study metric was over a figurative bank client who was looking into a merger with another financial institution.

How did the Career Center help you? I had a career mentor from the Career Center, and I also went to many Career Fairs throughout my college career.

Want to hear more of Shawn’s story? Check out his testimonial video!

Would you like to be featured in our Soaring Beyond Success Series? Email Jeanette Hickl. We’d love to share your story!